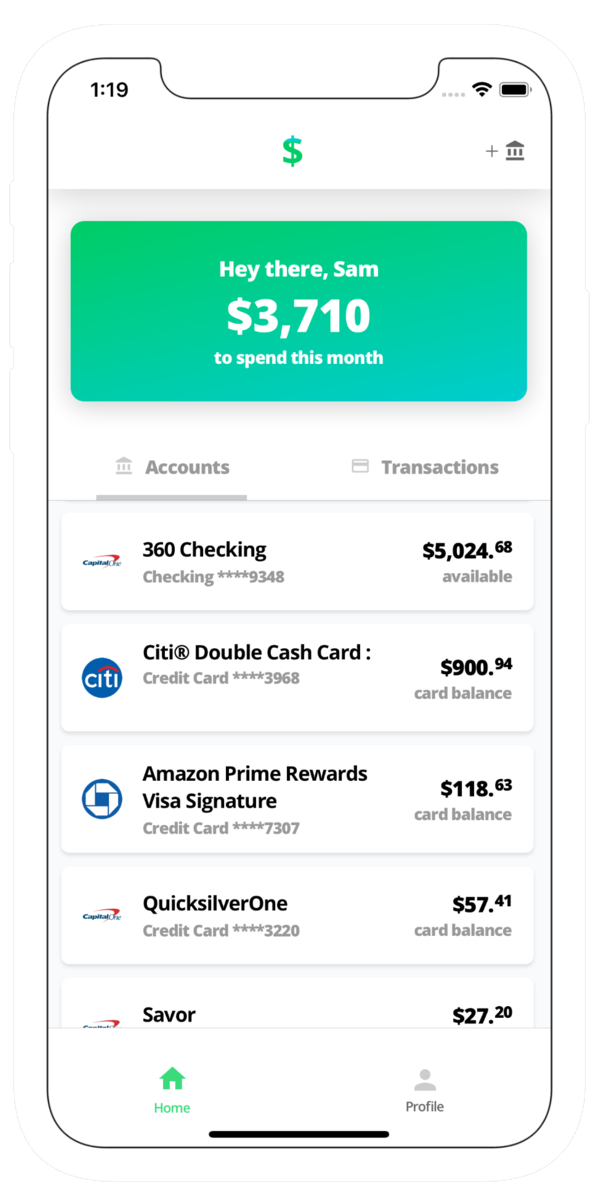

Know your spending.

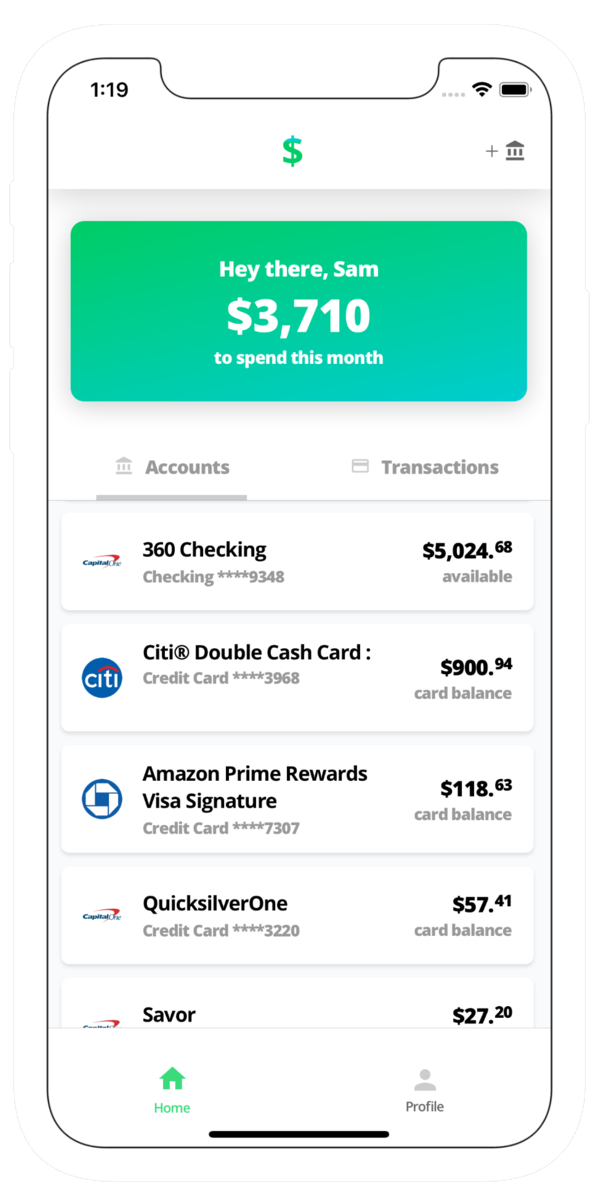

Know your spending.

Track what you spend with Pinch. Watch your monthly expenses and income automatically map to transactions that appear in your accounts.

Track what you spend with Pinch. Watch your monthly expenses and income automatically map to transactions that appear in your accounts.